Interest-Only BTL Mortgage Rates

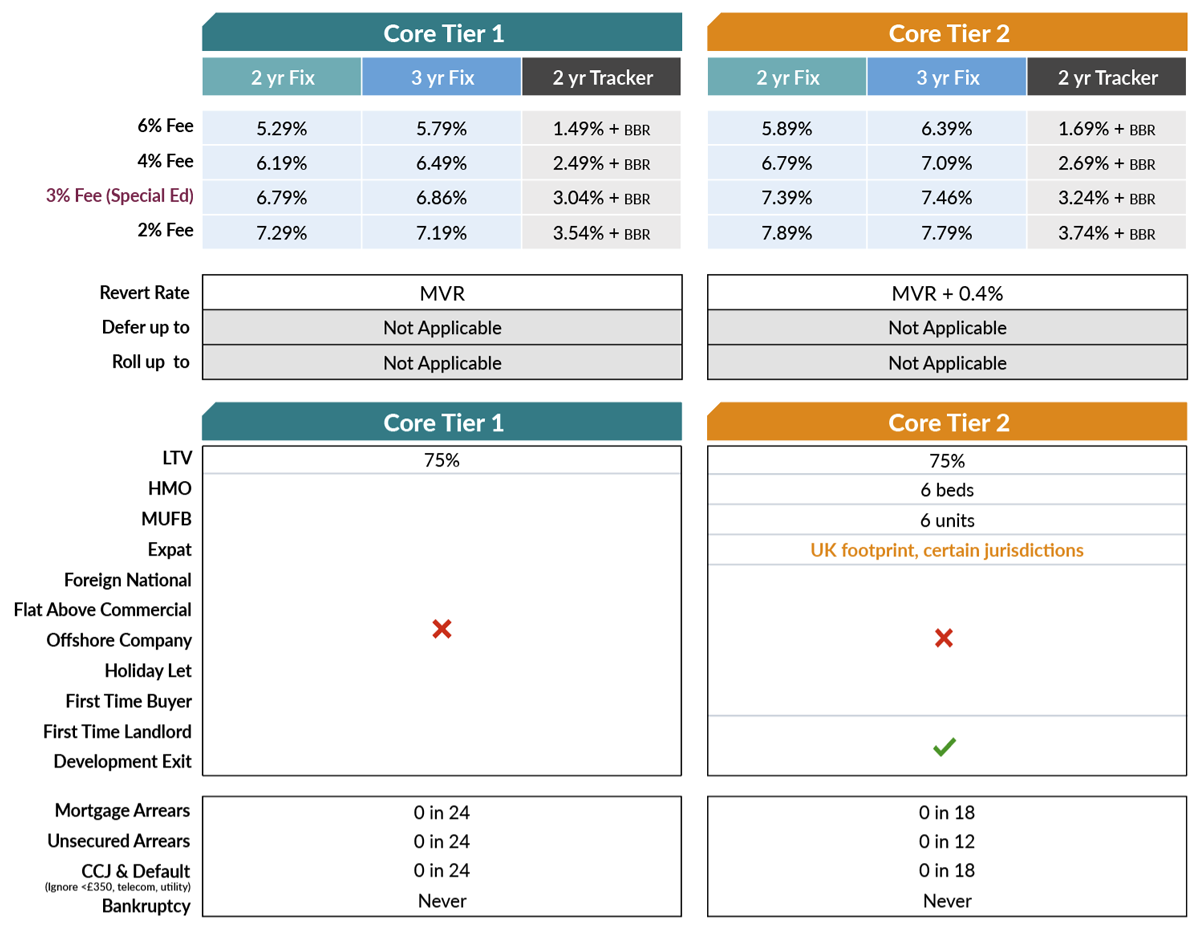

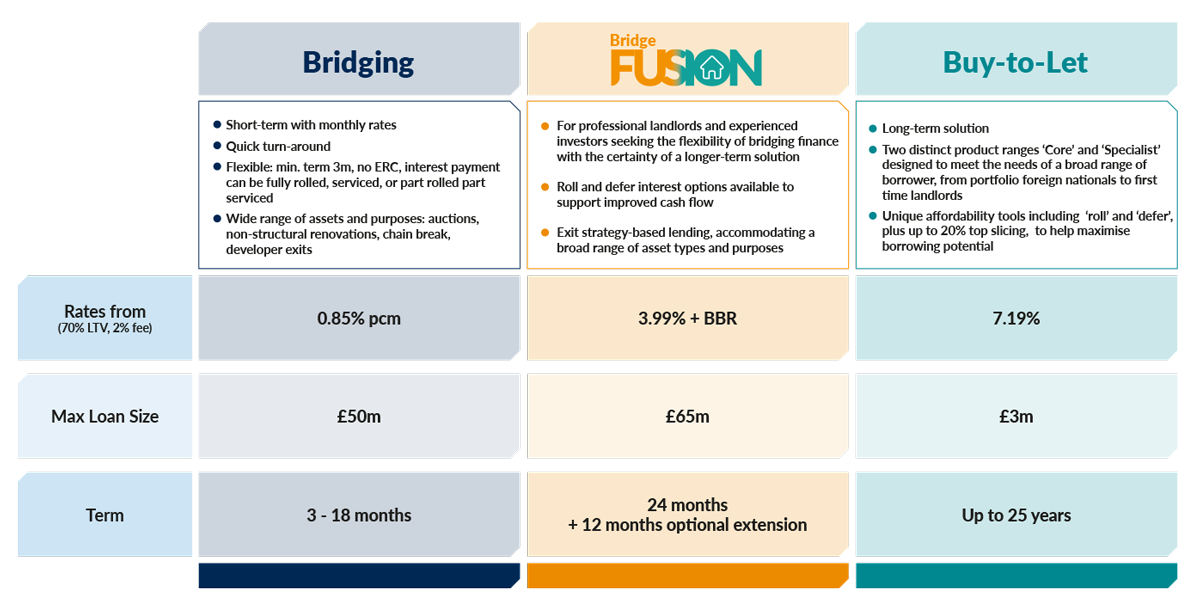

Buy-to-Let Core Range

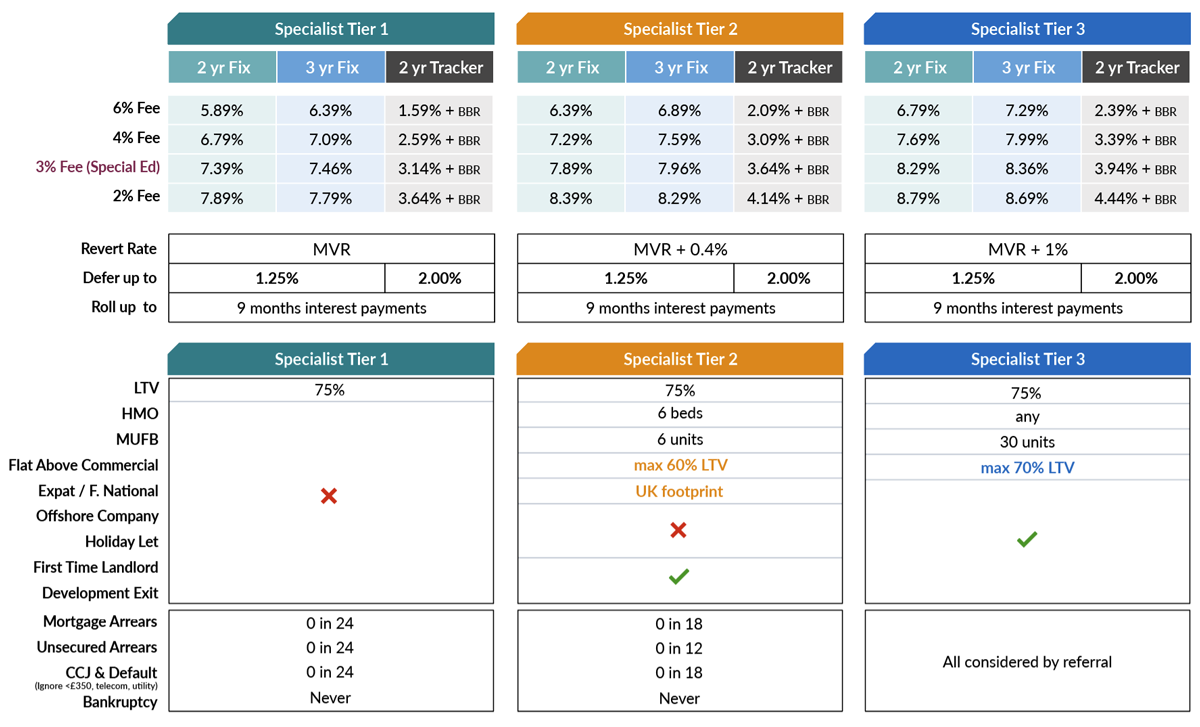

Buy-to-Let Specialist Rates

Residential Product Comparison

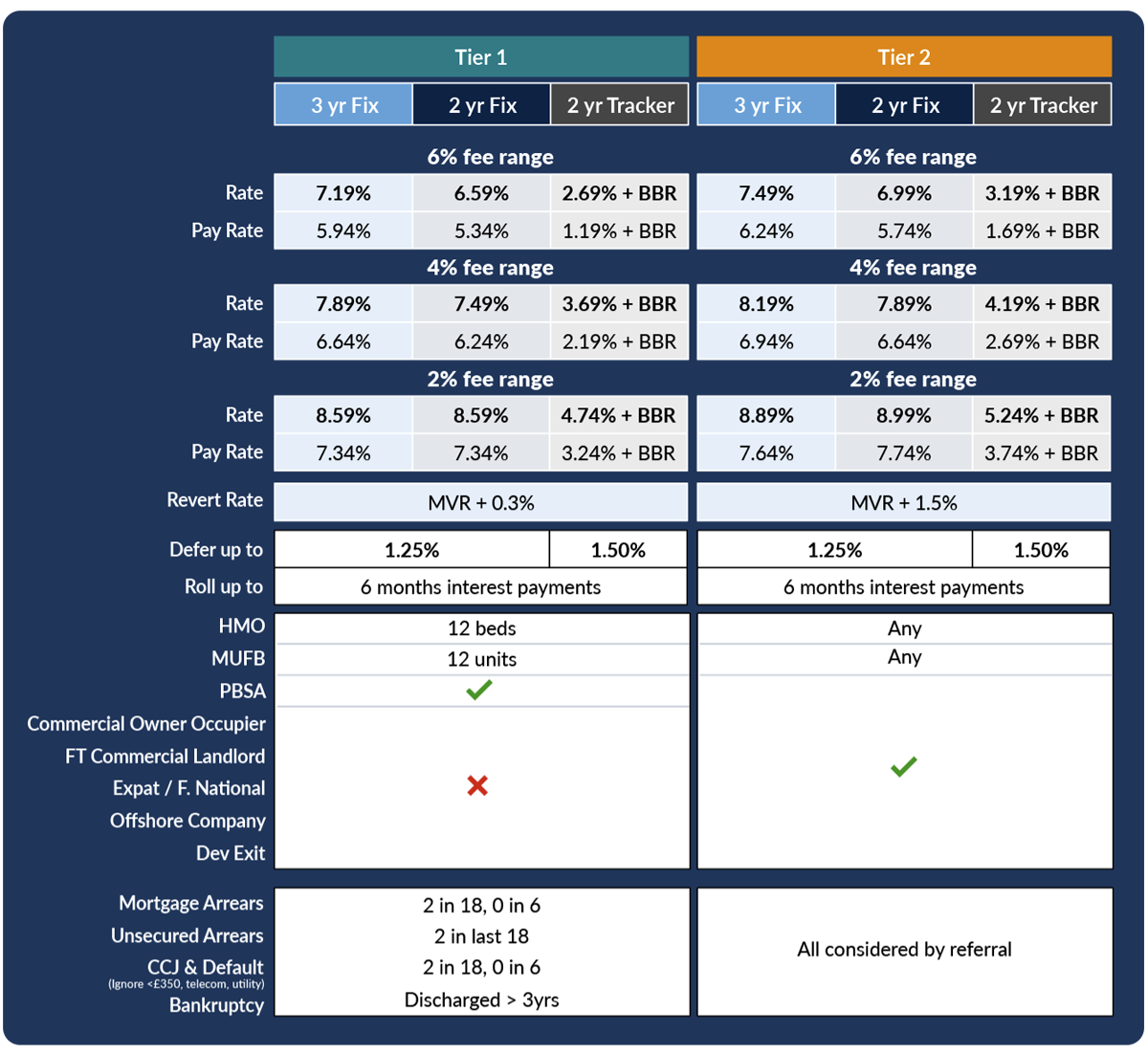

Commercial

Commercial Interest-Only BTL Mortgage Rates

Commercial Product Comparison

Market Financial Solutions’ Interest-Only BTL Mortgage Rates

We update our interest-only BTL mortgage rates on an ongoing basis. Meaning, this page has the latest information available. As is the case across all of our business and different products, clarity remains paramount – for both us and our underlying clients.

We split our residential BTL mortgages into up to three tiers. Our commercial BTL mortgages are split into two tiers.

These products and tiers ascend in scale, and are based on the complexity of the deal, and the borrowers’ circumstances. The most straightforward cases fall into the Buy-to-Let Core product range and in the tier 1 category, while the most complicated are reserved for the Buy-to-Let Specialist range and tier 3. The applicable interest-only BTL mortgage rates that borrowers pay will be dependent on what product and tier they fall in.

Factors that influence interest-only BTL mortgage rates

There are many factors that influence what product and tier a borrower falls into, and therefore what rate they will ultimately pay. The type and size of the property, a borrowers’ credit history, their experience, their setup, the loan size, LTV, and more will all have an influence.

Across all our products, all borrowers will be able to benefit from flexibility. Both fixed and tracker options are available, as are deferred and rolled up repayment plans. All our BTL deals are underwritten from day 1 of an enquiry, meaning we’re there to address any issues or concerns as they arise.

Why work with Market Financial Solutions

There are many ways to get the ball rolling with us. An initial enquiry can be made through our website, over the phone, via email, or in-person at the various events we attend throughout the year. All enquiries we receive will be responded to within 4 hours.

But this isn’t the only reason brokers and borrowers should turn to us for our interest-only BTL mortgage rates. Market Financial Solutions has been at the forefront of the specialist finance industry for nearly 20 years and with the launch of our BTL mortgages in 2022, we brought bridging-like speed and flexibility to the rental market.

Just as is the case with our bridging loans, our BTL mortgages are assessed on a case-by-case basis. Every borrower we work with has a solution that is tailored to their circumstances. Also, we have tools and resources at the ready to help property investors with their decisions. This includes comprehensive guides, independent research reports, and interactive BTL calculators.

The latter allows users to gauge what interest-only BTL mortgage rates may be available to them ahead of an enquiry, but the results will only be calculated estimations. To get detailed quotes, users should reach out to us today to get the ball rolling.