(Version 04-2024/1)

Interest-Only Buy-to-Let Mortgage Rates

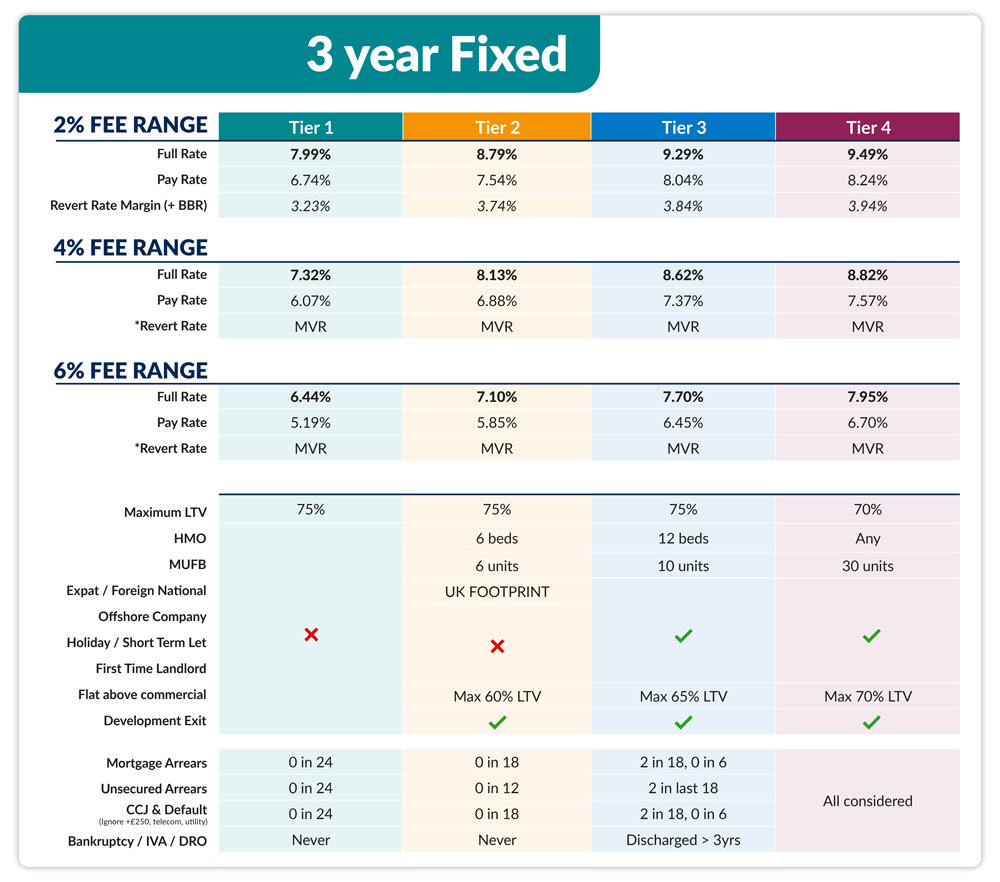

3-Year Fixed Buy-To-Let Mortgage Rates Table

Flats above commercial: Above (or immediately adjacent) commercial premises up to max Tier LTV, except when a restaurant, takeaway, pub, or launderette; max LTV 60% Tier 2, 65% Tier 3, and considered to 70% Bespoke Tier 4.

UK footprint: Have active credit, accounts, or property in the UK. Offshore Foreign Nationals, Companies, or Expats without this assessed on Tier 3 or 4; min rent ICR may be increased, term cap 24 months, or interest payments retained from the loan at underwriter discretion.

Rolled interest: Over 6 months interest, to a maximum of 9 months, can be rolled-up at Underwriter discretion and plausibility assessment.

Deferred interest: Up to a maximum of 1.25% over whole term deferred at underwriter discretion and plausibility assessment.

ERC: 4%/3%/2%. No ERC during revert rate period.

Admin Fee: £199 per property (max £995), non-refundable, paid with val fee.

Pay rate: The rate shown utilises the highest available deferred interest option for the product.

*MVR: Last set on 01/10/2023

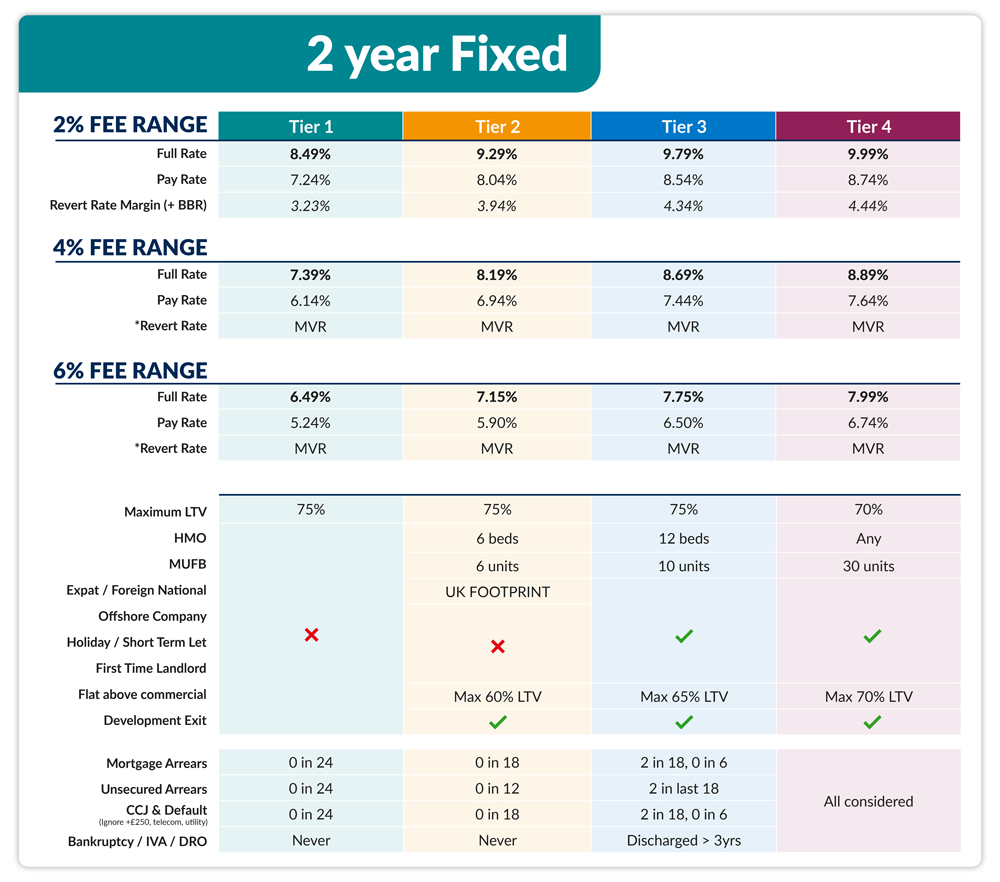

2-Year Fixed Buy-To-Let Mortgage Rates Table

(Version 04-2024/1)

Flats above commercial: Above (or immediately adjacent) commercial premises up to max Tier LTV, except when a restaurant, takeaway, pub, or launderette; max LTV 60% Tier 2, 65% Tier 3, and considered to 70% Bespoke Tier 4.

UK footprint: Have active credit, accounts, or property in the UK. Offshore Foreign Nationals, Companies, or Expats without this assessed on Tier 3 or 4; min rent ICR may be increased, term cap 24 months, or interest payments retained from the loan at underwriter discretion.

Rolled interest: Over 6 months interest, to a maximum of 9 months, can be rolled-up at Underwriter discretion and plausibility assessment.

Deferred Interest: Up to a maximum of 1.25% over whole term deferred at underwriter discretion and plausibility assessment.

ERC: 4%/3%. No ERC during revert rate period.

Admin Fee: £199 per property (max £995), non-refundable, paid with val fee.

Pay rate: The rate shown utilises the highest available deferred interest option for the product.

*MVR: Last set on 01/10/2023

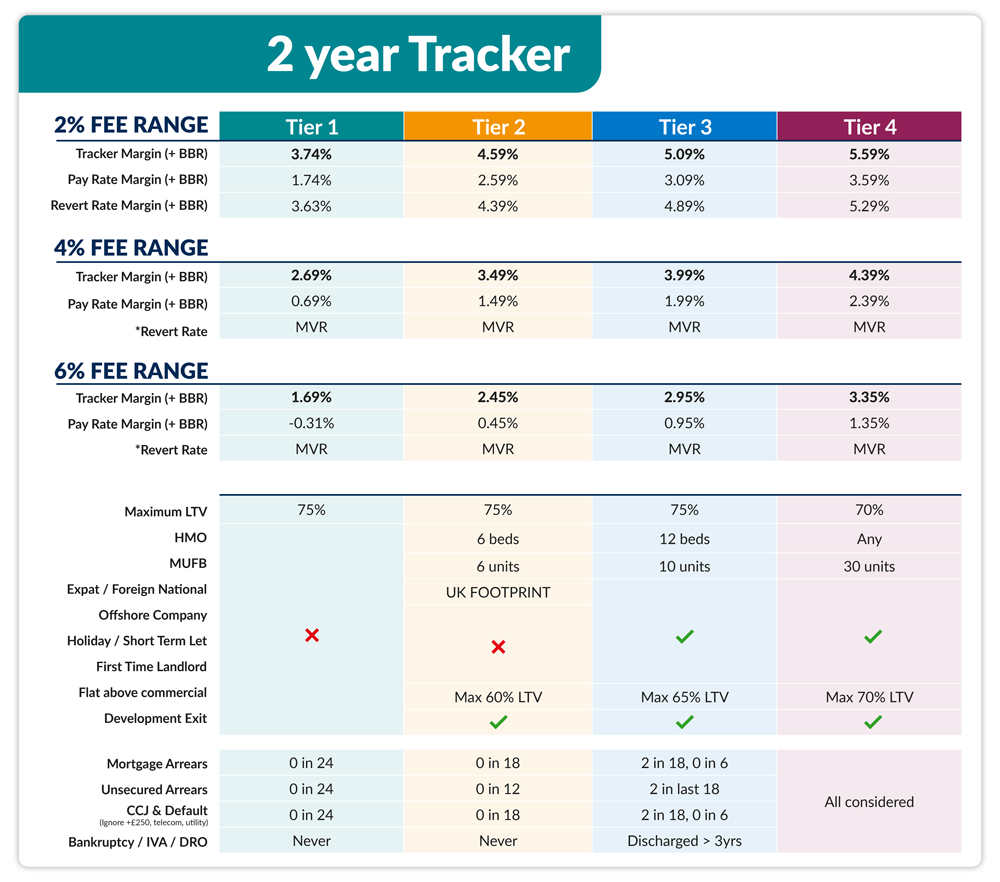

Tracker Buy-To-Let Mortgage Rates Table

(Version 04-2024/1)

Trackers: Any changes to BBR applied from 1st of the following month. Any rolled up & capitalised months are calculated at TODAY’S BBR, not a predicted future value. MFS may use a stressed BBR to calculate max loan or require additional income evidence to prove resilience. May use 180 day valuation.

Flats above commercial: Above (or immediately adjacent) commercial premises up to max Tier LTV, except when a restaurant, takeaway, pub, or launderette; max LTV 60% Tier 2, 65% Tier 3, and considered to 70% Bespoke Tier 4.

UK footprint: Have active credit, accounts, or property in the UK. Offshore Foreign Nationals, Companies, or Expats without footprint this assessed on Tier 3 or 4; min rent ICR may be increased, term cap 24 months, or interest payments retained from the loan at underwriter discretion.

Rolled interest: Capitalise a number of months interest, paid at redemption. Can boost loan size or provide time to do light refurb/find a tenant.

Deferred Interest: Capitalise part of the interest rate during initial period, paid at redemption. Reduce direct debit size or boost loan size.

ERC: 3%/2.5%. No ERC during revert rate period.

Admin Fee: £199 per property (max £995), non-refundable, paid with val fee.

Pay rate: The rate shown utilises the highest available deferred interest option for the product.

*MVR: Last set on 01/10/2023