Bridging Loan Rates

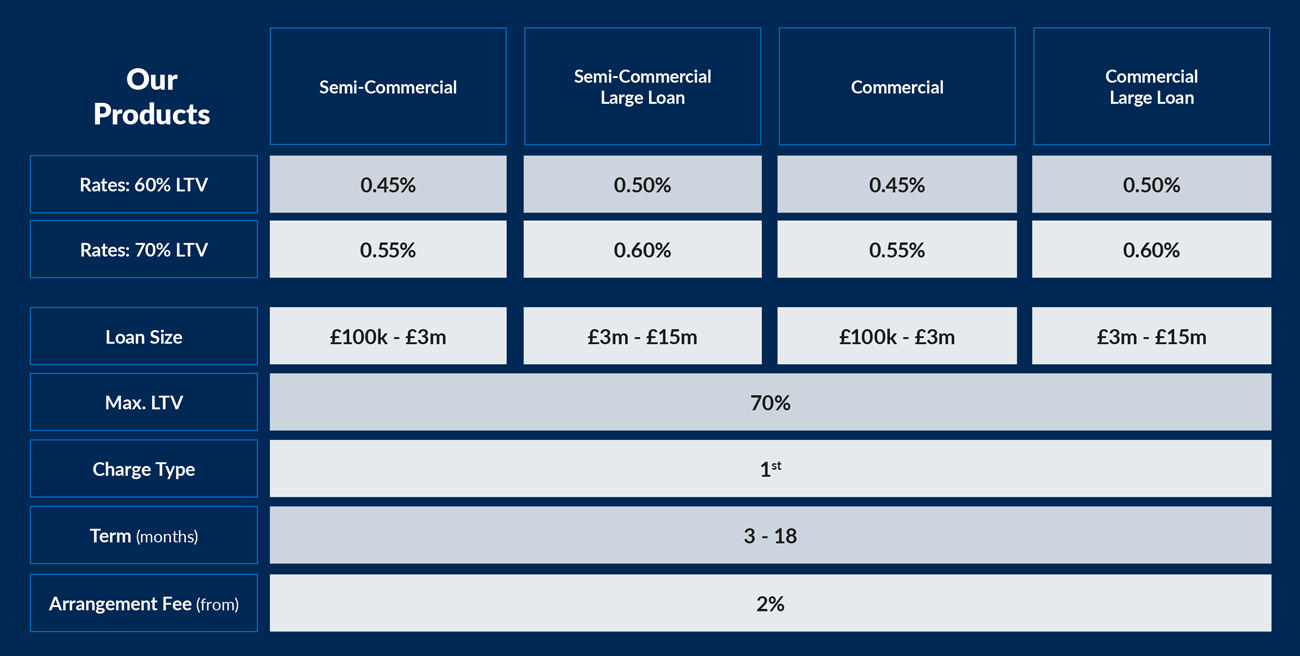

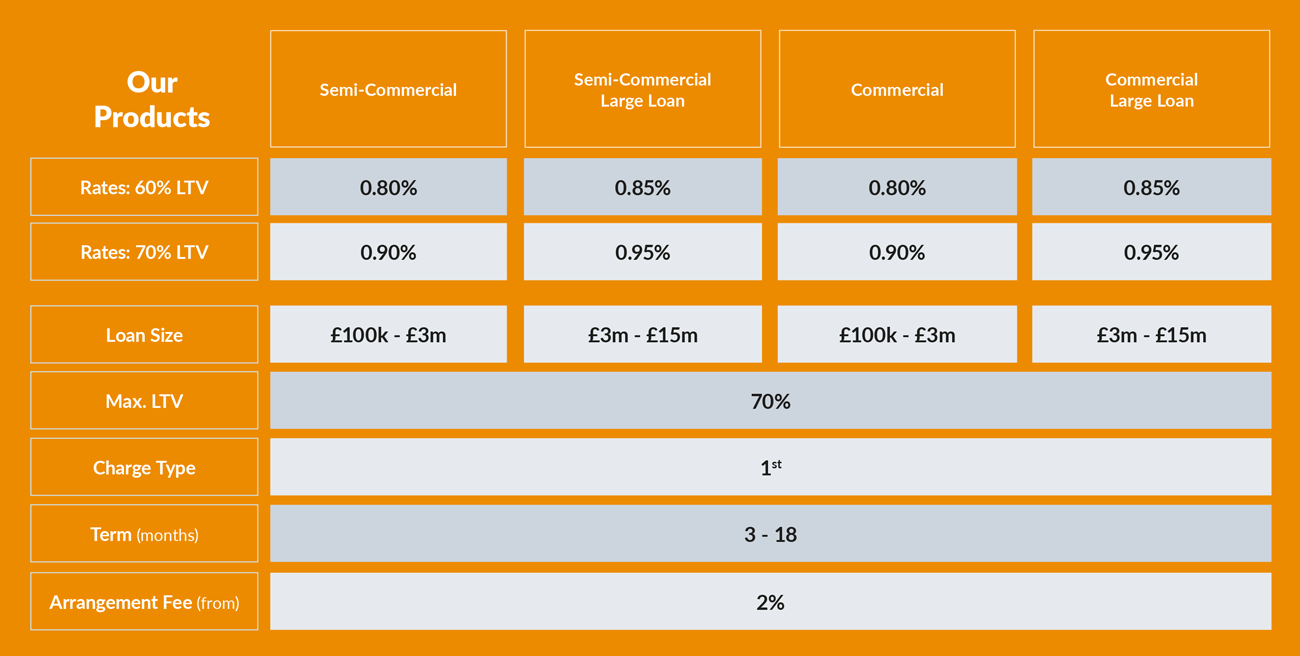

Commercial

Contact us

Get in touch via phone, chat or email about your query, however complex it might be. We are here to help.

Email: info@mfsuk.com

Phone: +44 (0)20 7060 1234

Leave us a message

Market Financial Solutions Bridging Loan Interest Rates

We update our bridging loan rates on an ongoing, live basis. This means what you see on this page is the absolute latest information available. As is the case across all of our business, clarity remains paramount – for both us and our underlying clients.

What affects your rate?

The bridging loan interest rates we have on offer will be varied by a range of factors. A borrower’s specific circumstances will be amongst the most important elements in determining what bridging loan rates are issued. This can include a borrower’s financial background, whether they’re based overseas, and if there are any CCJs against them.

The type of property being invested into will also have an impact on rates. We offer loans for a broad range of property types, but each will be assessed on a case-by-case basis. A loan for a residential, one-bedroom apartment will likely have a much different rate to a large commercial logistics hub. How the property investment will be utilised down the line will also affect the bridging loan rate. Before the issuing of any loan, Market Financial Solutions thoroughly ensures there is a solid exit strategy in place.

As is the case with any lender, our bridge loan rates are also subject to the wider economic climate. Chiefly, this concerns decisions made by the Bank of the England on the base rate. Where we are forced to raise our rates, we go out of our way to let our brokers know asap. Additionally, all of our marketing materials will be updated to reflect the changes.

Service at the forefront

To ensure our brokers and underlying clients receive the fairest bridging loan interest rates, along with unparalleled service, all of our deals are assigned to a designated underwriter. Our underwriters go out of their way to provide the best possible deal. This includes doing all the heavy lifting. They’ll chase paperwork; liaise with lawyers and valuers; and analyse the wider market. This is all done to make sure we understand the full picture and limit your outgoings wherever possible.

With this dedication in place, we can fix our bridging loan rates securely so you can invest with confidence. Once the terms are agreed, we’ll never go back on a deal. When we say yes, we mean it. To see what rates we can offer you, give us a call and we’ll be happy to help you.

FAQs

How quickly can you complete?

We can work as quickly as the case allows. Once terms are agreed and we have the documents we need, we can move fast. Your dedicated underwriter will help keep momentum by liaising with lawyers and valuers and chasing documents.

Are the rates on this page live?

Yes. The bridging loan rates shown are updated on an ongoing basis so you’re seeing the latest available information.

Do you lend to overseas borrowers?

Yes, we can consider overseas borrowers. We’re able to consider applications from most jurisdictions (excluding sanctioned territories). We support UK-based expats, offshore borrowers, trusts and corporate applicants, including more complex cross-border structures, such as overseas buyers purchasing offshore-held assets, or moving ownership from offshore to onshore. You don’t need to already hold UK assets to be considered.

Will CCJs or adverse credit rule me out?

Not automatically. We look at the full picture, including circumstances, the asset, and the proposed exit strategy. So do get in touch and speak to one of our underwriters, how we can structure your loan.

What fees should I expect alongside interest?

Total cost typically includes interest plus fees such as an arrangement fee, valuation fee, and legal fees. If an exit fee applies, it will be confirmed during the application process.

What do you need to give me a clear indication of pricing?

To move quickly, we’ll usually need: the property address and details, the loan amount and term, your exit strategy, and a summary of your circumstances (including anything that may affect underwriting). The more information we have upfront, the smoother the process will be.