Business Development Manager

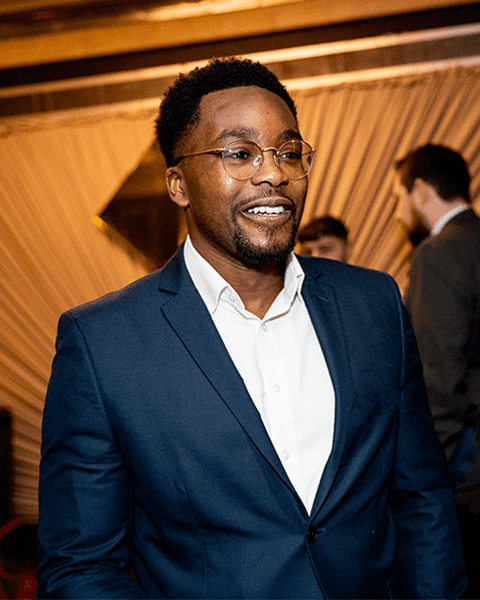

Meet…

Peter Olasoji

Business Development Manager

I have been working in property finance for over a decade, specialising in providing investors with bridging loans in London, especially in North & East London and around the South East.

I’ve built expertise in supporting businesses, as well as individual investors with their BTL goals, as well as bespoke bridging needs. Having recently joined MFS, I’m now able to help borrowers with diversified specialist loans.

I’m keen to work with brokers, investors, and developers who may be in need of acquisition finance, development exit funding, auction loans and more.

Email: peter.olasoji@mfsuk.com

Phone: +44 (0)7498 959 117

“It’s all about problem solving for people with real life circumstances.”

Regions I cover

I offer bridging loans and specialist BTL mortgages for Greater London.

The specific regions I cover are:

- North London

- East London

- East Central London

- Ilford

- Romford

Contact me

Email: peter.olasoji@mfsuk.com

Phone: +44 (0)7498 959 117

Introducing Peter

Peter is one of our newer BDMs at Market Financial Solutions, but he’s already making a name for himself in the scene. Peter is courteous to everyone he works with – colleagues, brokers, and other stakeholders – and he is regularly commended for providing a personable service.

Primarily working on bringing bridging loans to east London, North London, and the Romford area, Peter is keen to shine a light on what these areas can offer. He isn’t solely focused on helping property investors expand with bridging finance for London and the Southeast, he wants to see the regions he works in thrive.

We sat down with Peter to understand how he’ll achieve this in tandem with his clientele, as well as find out what keeps him motivated in this market.

Interview with Peter Olasoji, MFS’ Business Development Manager for East London, East Central London, and North London

Most of Peter’s experience has been built within the finance industry, providing him with a solid foundation for all things bespoke lending.

“So, I started off in the finance industry straight after Uni,” he said, when asked about how he got into the industry.

“I joined Funding Circle which is a small to medium sized business lender and from there I realised I just love working with brokers.”

As Peter began to work with bigger and bigger brokers, handling larger loans as a result, he found himself moving into the invoice financing industry. Then following a career break, he started covering large bridging loans in London, along with BTL finance. After nearly 5 years of honing his skills, he joined MFS in December 2023.

What do you enjoy about the specialist finance market?

“I enjoy how flexible and fluid it is. You know, every case is different – there’s always a new complexity that you’ve got to solve. I like solving problems and that’s what this industry is all about.”

Peter explained that one day he may be working with a client who needs to purchase a property quickly. The next, it’s a borrower who has adverse credit and is struggling to progress. These kinds of issues require unique, tailored solutions and working through the complexities is what bespoke lending is all about.

“It’s all about problem solving for people with real life circumstances.”

Indeed, rarely does any property investment strategy run completely smoothly. In this market, we need to be ready for any surprises or challenges that could emerge.

“I enjoy that part of the business, you know. Figuring out how to make something work, and keep the client happy at the end of it.”

What is it you think you offer to the brokers you work with?

Peter laughed as he mentioned that sometimes, he needs to remind himself that those he works with are business associates first, and friends second, as he forms true connections.

“I like to show my personality,” he said.

“I like to help people; I like to know more about people. It’s interesting to me, I like to talk and find out new things about people – I don’t want these relationships to be purely transactional.

“I’ve been working with some brokers for 10-plus years and in this industry, people remember how you helped them. They may not remember the specifics of the deal, but they remember how you helped them get it all wrapped up, and the care you gave from the beginning.”

This care Peter puts into his cases is one of his key strengths. Due to the relationships he’s developed over the years, he has been able to welcome new clients into the MFS fold for the first time, opening up new avenues for opportunity for all involved. Of course, that doesn’t mean there isn’t scope for further success or improvements down the line.

What would you like to see introduced or prioritised in the specialist finance market?

There could be scope for our industry to become even more harmonious, according to Peter.

“Collaboration. You know, some brokers are really good with BTL products, but not so good with bridging loans in London. Sometimes, without understanding what’s out there, they’re not able to help their clients, or know who to send them to.

“I think there’s space for brokers, brokerages, and lenders to collaborate and learn from each other. There’s scope for lenders to learn about how brokers work and the things that bug them the most, and what they need to circumvent those issues.

“On the flip side, brokers need understanding of the lenders perspective – why there are restrictions in place and why that means we may not be able to do certain deals over others. We just need more open and honest conversations”

We couldn’t agree more. It’s why on the other side of our business, our teams underwrite all our deals from day one of an enquiry, ensuring our brokers and borrowers know exactly where they stand from the outset. We also need to have more collaboration and open discussions on where we could be focusing our efforts in the UK.

Where do you think there’s opportunity for property investors, and where would you like to see more funding directed to?

We are not financial advisors or wealth planners. We would never advise our borrowers on where or how they should invest. But, having worked with bridging loans in London for some time, Peter has picked up on what’s proving popular with borrowers.

“That’s a tough one,” he said, noting that he doesn’t want to give an overly obvious answer.

“What I would say, based on the current market, there are a lot of developers out there that aren’t able to flip onto BTL mortgages. So, there might be an opportunity for bridge loans in London to facilitate that.”

But what exactly would that look like?

“Well, that could be a developer exit product or, there are some clients out there that could snap up some new builds on a bridge, wait for the market to be in a more competitive place, and then move onto a BTL mortgage.

“There might be opportunity for some borrowers to look at new builds, but they’ve got to be correctly priced, and not overvalued.”

Entry costs have held many would-be investors back from London and the South East. But, at the same time, much of the capital is in desperate need for development and bit of TLC. Where would Peter start if he could funnel some money himself?

“I would always say East London, just because I’m used to seeing East London – there’s a lot of good space. There’s a lot of growing demand to be in that area which is close to Central, has good transport links and all of that.

“There are definitely areas that could be revamped but obviously, with that comes the dreaded word of gentrification. So, it’s like, how do we balance it all, and make sure the local culture is still there?”

It’s a challenging question to address but, once it’s figured out, Peter will be there with bridging loans for East London at the ready.

Are there any typical borrowers or cases that you tend to work with?

“Since moving to MFS, I’ve been able to help brokers who have offshore clients on their books, which I haven’t been able to do before. I’ve been getting quite a few enquiries in that space, which I find very interesting.

“The fact that we can lend to those clients, even with the enhanced due diligence required, is a unique MFS speciality.

“Also, I’ve seen a lot of first time buyers and the fact that we can actually help a client who has never bought in the UK before – yeah, that’s amazing.”

What do you like specifically about your corner of the market?

As mentioned, Peter provides bridging loans for East London, North London, Romford, and more. What’s more, he can deliver BTL funding for these regions and beyond. But what does he enjoy about working in this corner of the capital?

“For me, it just feels like home,” he said.

“It’s where I grew up. I love these areas, I like looking at the developments in these areas and how cases have changed. Everything’s on my doorstep.”

What do you do to get your mind off the world of property finance?

We all need our R&R. Peter, especially, works incredibly hard, so we’d be worried if he didn’t switch off every now and then!

Shockingly, Peter turns to football for this.

“Anyone who knows me knows I’m a big Man United supporter. I love football. Even though we’re not doing as well right now, I still love seeing what every other team is doing.

“I’m a secret Arsenal supporter too, as I’m from North London. Even thought they’re rivals, I like seeing how good they’re both playing.

“Also, I’m a new dad, so that keeps me busy. I’m enjoying being a new dad and experiencing the joys that come from having a son. Everyday is like a blessing. But that’s basically me outside of work – football and being a dad!”

There you have it, bridging finance in London coupled with football rivalries. If you need a BDM who can deliver large bridging loans in London and beyond, who also shamefully supports two premier league teams at the same time, reach out to Peter today!

Get in touch

No matter if you have a deal in mind or you just have a question about our products or criteria, give me a call or drop me an email. I’m happy to have a chat.

Email: peter.olasoji@mfsuk.com

Phone: +44 (0)7498 959 117