Q3/23 Report

How have product withdrawals affected homeowners and homebuyers?

To keep pace with the rapid base rate increase, many mainstream lenders have withdrawn their products. Our industry report reveals how that has affected homeowners, homebuyers, and BTL investors across the UK property market.

Get your free Report with additional infographics below.

How have product withdrawals affected homeowners and homebuyers?

Over the past 18 months, the economic climate has been defined by the Bank of England’s battle with inflation. The corresponding interest rate decisions on Threadneedle Street have had an immense impact on the UK’s mortgage market.

With inflation remaining sticky throughout the majority of 2022, and first half of 2023, the base rate has now been hiked on 14 consecutive occasions. Currently, it’s sitting at 5.25% – the highest it has been since April 2008.

To keep pace with the rapid increase to their own borrowing costs, many mainstream lenders and building societies have been forced to raise their rates as well, placing a significant strain on mortgage customers in the process.

As a result, it was recently reported that mortgage rates had hit a 15-year high. The average rates on two-year deals have passed 6.66%, according to Moneyfacts.

Meanwhile, other lenders have chosen to withdraw their products altogether, often leaving prospective buyers, or people looking to remortgage in the lurch. In May this year, for example, Moneyfacts research showed the choice of residential mortgage products on the market was reduced by more than 373 in less than a week, while buy-to-let (BTL) mortgage options declined by 405.

Clearly, such volatility and uncertainty will have had a major impact on those seeking property finance in the current climate. Many people may have been forced into adapting their property-purchasing plans to react to such a turbulent period.

In this report, we will explore the findings and reveal how product withdrawals have affected homeowners, homebuyers, and BTL investors across the UK property market.

Key findings at a glance…

Between 1st and 5th July 2023, we surveyed 2,000 UK adults, finding that an eighth of all Britons (250 people in the sample) had applied for a mortgage in the year leading up to 30th June 2023. This is what we discovered:

The challenges of the mortgage landscape:

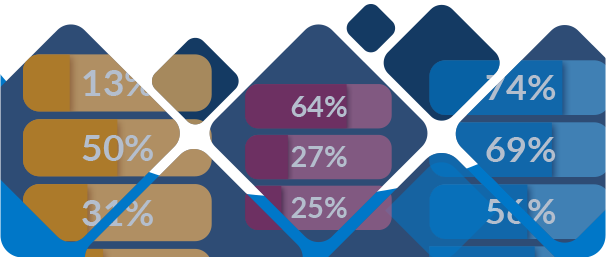

- 13% of UK adults (6.8 million people) have applied for a mortgage in the past 12 months

- 50% saw their desired product withdrawn by the lender before they could secure it

- 31% had an agreement in principle in place that later fell through

- 43% have been turned down by one or more lenders in their hunt for a mortgage since last July as a result of affordability issues

The impact of these challenges:

- 64% suffered with stress and anxiety due to challenges of securing a mortgage

- 27% missed out on a property purchase due to difficulties in getting a mortgage

- 25% lost money on fees and legal costs due to a purchase falling through

Evolving to meet borrower needs:

- 74% feel there is a lack of certainty being provided by lenders at present

- 69% think lenders are not showing enough flexibility

- 56% are more open to the idea of working with alternate or specialist lenders

- 69% consider brokers to be essential in navigating the mortgage market at present

The challenges of the ever-changing mortgage market

MFS’ research clearly demonstrates that the mortgage market is proving difficult to navigate, and that the consequences for those applying can be severe.

Our survey showed that 50% of customers found that the mortgage they desired was withdrawn by the provider while they were in the process of applying for it. A further 31% said they had a mortgage agreement in place that later fell through. Interestingly, among property investors these figures rose to 61% and 36% respectively.

Obviously, with rates rising and inflation eating into spending power, a significant number of people no longer have an income sufficient enough to afford a mortgage in the current climate. As a result of this, nearly half (43%) of respondents said they have been turned down for a mortgage following affordability checks. Furthermore, 27% of respondents admitted that they have lost out on a property purchase because of difficulties in securing a mortgage, while a quarter (25%) of mortgage customers who have seen a purchase fall through have lost money on agent fees and legal costs as a result.

Meanwhile, despite the fact that not all buyers are having to abandon their purchasing plans in the current market, some have had to change their strategies in order to acquire a mortgage. Our research also shows that 33% of people have been forced to take out a mortgage with higher rates because a lower-offer rate was pulled at the last minute.

The impact of these challenges

The uncertainty in the mortgage landscape is not only having a knock-on effect on people’s investment plans, but also on their day-to-day lives.

A staggering (64%) of mortgage applicants from the past year said that they have struggled with stress or anxiety because of the challenges of securing a mortgage product. Meanwhile, the same majority (64%) said that they were searching online at least once a week to uncover the best mortgage rates available.

This shows that borrowers need a lot more support, and perhaps suggests that mainstream mortgage providers – as well as the government – are not doing enough to help.

In fact, only 35% of mortgage applicants believe that the government is doing enough to calm the mortgage market. The wider impact that these challenges are creating are relatively easy to identify.

With fewer people in a position to take out a mortgage and invest in the UK property market, Zoopla research suggests that sellers are discounting their homes to achieve a sale. In fact, the average reduction is sitting around the £14,000 mark.

Consequently, we have seen house prices soften in recent months. Indeed, despite the fact that annual house price growth remains at 3.5% according to the Office for National Statistics (ONS), prices now sit £7,000 below their peak in September 2022.

However, it is important to note that, although prices have fallen this year, the average house price remains well above pre-pandemic levels, reflecting how resilient bricks and mortar can be in the face of such challenging economic and social headwinds.

A lack of certainty and flexibility on the high street

Another noteworthy trend our research has uncovered is that borrowers believe that mainstream mortgage providers could be doing more to finance and support their clients in the current economic climate. This lack of support has led to an uptick in demand for alternative sources of finance.

Indeed, as indicated by 74% of respondents, there is currently a lack of certainty and assurance from lenders. With so many lenders pulling products or withdrawing offers, this is hardly surprising, However, it is unfortunate that so many (47%) borrowers do not feel as if mortgage lenders are providing them with enough support and communication about product changes.

Meanwhile, a majority (69%) of people say that lenders lack flexibility at the moment. This makes it increasingly difficult to acquire – let alone afford – the mortgages that borrowers are looking for.

Borrowers are turning to brokers and specialist lenders for help

The result of this trend is that the demand for specialist finance, as well as the support of mortgage brokers, is on the rise. In Q1, for instance, bridging lending rose by 11.8% according to the Association of Short Term Lenders (ASTL), with completions, applications, and loan books all seeing a quarterly rise.

Further evidence of this can be found in our data:

- Over half (56%) say that they are now more likely to look for alternative lenders to help them finance a property purchase.

- This figure rises to 68% among respondents who labelled themselves as property investors. Meanwhile two thirds (59%) of all respondents indicated that they had used the services of a mortgage broker in the last year.

- Interestingly, an even larger majority (69%) said that they now see mortgage brokers as essential for navigating the mortgage landscape.

A word from our CEO

“Before the Bank of England started hiking the base rate in January 2022, the interest rate environment in the UK enabled the property market to achieve an unprecedented amount of growth. Therefore, when interest rates started rising to the levels they have been historically, there was always going to be a period of transition as lenders, borrowers, and brokers alike all came to terms with the new higher-rate era.

“Our research clearly shows that we are in the midst of this period of transition, and it would be remiss to suggest that the challenges that borrowers have faced are not going to continue for a little while yet.

“However, although lenders obviously need to adapt their rates to maintain profitability as their own borrowing costs rise, there are certainly other methods of supporting borrowers that are not being utilised as fully as they could be at present – methods that specialist lenders can provide.

“For instance, optionality remains vital, and the fact MFS can provide bridging loans and BTL mortgages, as well as flexibility in our products and terms, means we can better support clients. Moreover, we provide certainty in an uncertain climate – when we say ‘yes’ to a client, we mean ‘yes’.

“Plus, in June we committed to freezing our rates until August, providing peace of mind to clients – we have seen first-hand the uptick in demand for specialist finance as a result.

“Indeed, the last few months have been extremely busy; working with brokers and borrowers who have been let down as other lenders have pulled out of deals has been a common theme in the enquiries we have received, while a rise in the number of property investors seeking to take advantage of softening prices and homebuyer demand is another important factor driving up demand for our products.

“For those borrowers who want to capitalise on the opportunities that the current market is providing but require the flexibility and certainty that many highstreet mortgage lenders cannot provide, we remain steadfast in our mission to provide the finance that they need to invest in the UK property market with confidence in the months to come.”

– Paresh Raja, CEO, Market Financial Solutions